Starling, the U.K. challenger bank that offers a mobile-only current account, continues to execute on its marketplace banking strategy. Following the required regulatory approval, the Starling Marketplace is adding a number of financial services integrations, spanning pensions, savings, travel insurance and mortgage brokerage.

Specifically, Starling is partnering with PensionBee, Wealthsimple, Kasko, and Habito, respectively. It says it’s targeting 25 partnerships in total in 2018. The challenger bank has already added Flux to its in-app marketplace to offer item-level receipts and loyalty from Flux partner merchants.

The addition of financial services speaks to Starling Bank’s broader “marketplace banking” vision: the idea that your bank will provide you with access to a choice of third-party money-related apps and services. It’s also more evidence that the battle between banks and fintechs isn’t a zero sum game. Partnerships are being forged at a rapid pace, either formally or simply through open APIs mandated by Open Banking/PSD2 legislation.

In fact, at a recent event I hosted, Starling’s Chief Platform Officer Megan Caywood also made the point that the challenger banks and wider fintech startup ecosystem are in many ways on the same side. Fintechs run on existing banking rails and whose better banking rails to run on than the forward-thinking and API-friendly challenger banks, rather than incumbents.

Meanwhile, the Starling Marketplace strategy is to partner far and wide to create a network effect on both sides of its market where the app becomes more useful the more users and partners/integrations it adds. The addition of a first group of financial services covering core banking needs other than a current account begins to flesh this out a little.

With that said, Starling isn’t disclosing customer numbers, while the integration with PensionBee, Wealthsimple, Kasko, and Habito is being rolled out in two stages.

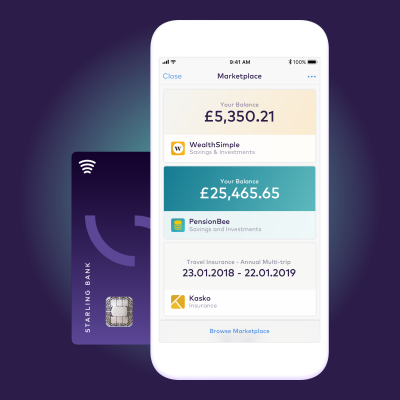

Version one sees each provider visible in the Starling Marketplace in the Starling app. If you are also an existing user of the partner app (e.g. an existing PensionBee user) then you can connect the partner to Starling, so you have the widget in the Starling app to see high level detail (e.g. Total Balance of pension). If you are a new user, you’ll be re-directed to the partner app and, once you’ve signed up, you’ll be asked if you are happy to share your data with Starling so that it shows up in the Starling Marketplace as a widget.

Version two, coming later in Q1, will see partner providers use the Starling API to help new users set up accounts (similar to Facebook type login but using your Starling credentials). The widget in the Marketplace will also gain functionality. In addition to showing high level data (e.g Total Balance), you’ll be able to take a number of simple actions like adding money to your pension or making a claim on your travel insurance, all within the Starling Marketplace.

“Those features will come later this year, as we also expand the ‘widgets’ to show a bit more detailed data as well,” Caywood tells me.

And in case you’re wondering, Starling will generate affiliate revenue per each of these partners, while I’m told this will be shown in the Starling Marketplace per partner so that customers are always made aware.

Adds Caywood in a statement:

“The expansion of our Marketplace is a huge milestone for Starling as we continue to give our customers control of their money like never before. We are building a banking experience fit for the 21st Century, where the best financial products are available securely in one place.

Last year, we launched our full set of Open APIs, and enabled integrations with companies like Moneybox, Yoyo Wallet, Yolt, Tail, and Flux. Now we’re excited to take that to the next level by integrating financial services providers into the Starling Marketplace.”