Recently launched out of beta, U.K. startup Shape wants to create a more educational trading experience for a new generation of traders, including those who might be concerned with the ethical standards of the sectors or companies they back.

The Shape iOS app assumes no or very little prior trading knowledge, and provides easy-to-follow information on how to make trades and what to look for when choosing stocks. Trades can also be executed via integration with popular brokerages, such as Fidelity, eTrade, and Vanguard.

More broadly, Shape is hoping to tap into a trend that has seen a number of new trading apps launch that aim to make it easier, cheaper and more accessible to start stock market trading, coupled with the needs of a new generation of first-time traders who are seeking clear and digestible market information.

“We built the app having seen an increase in accessibility following a surge in low fee platforms like Robinhood, Bux and other low cost trading platforms,” Shape co-founder Will Shimidzu tells me. “Our concern is that people are going in blind and that current stock research is, possibly by design, unnecessarily complex”.

To remedy this, Shimidzu says the Shape app attempts to break down trading concepts into a digestible format, informed by his own previous experience as an investment banker. “We also present analyst price targets and volatility data to help users be better informed on what they’re investing in,” he says.

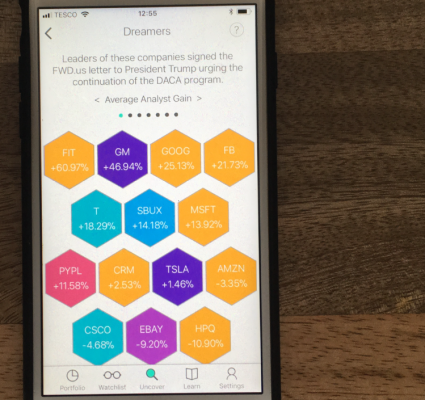

But it’s an emphasis on ethical investing that perhaps sets Shape apart, at least for inexperienced traders who would rather research and pick their own investments instead of putting their money into one of a number of ethical tracker funds.

“Our concern is that some of these funds aren’t actually ethical, despite being marketed as though they are. The biggest ethical fund in the U.K., for example, includes Vodafone, Shell and HSBC, who are hardly bastions of morality. For us, there’s no one size fits all solution to ethical investing, as, by definition, everyone’s morals are different,” says Shimidzu.

When you sign up to Shape you’re asked right away if there are any sectors you’d like to screen for, such as weapons, nuclear, alcohol, and tobacco. You then have the option to connect the app to your third-party brokerage account, although, regardless, you can still browse Shape for investment ideas by sector or by themes e.g. companies that are carbon neutral or are helping refugees.

Once you have an idea of a sector or theme you are interested in, you can dig deeper and get average analyst price targets, volatility guidance, and curated insights on the company’s ethical credentials. If you like a company, you have the option to add it to your watchlist or invest directly via connection to your third-party brokerage account. There’s a user-generated content aspect, too.

Explains Shimidzu: “We’ve placed an emphasis on trying to help users invest in line with their morals. We saw a huge shift in the institutional space of ESG investing and have incorporated a community-driven approach to content curation. Say I see something in the NYT about H&M deliberately overproducing clothes to pressure their supply-chain to lower the costs, I can pin that to H&M’s profile page on Shape so others know about it”.

Source link